An environmental policy professor explains how the Regional Greenhouse Gas Initiative is helping Virginia lower its emissions amid a data center building spree that’s expected to drive a 38% increase in electricity use by 2035.

Article Source: Energy News Network

Article Link: https://energynews.us/2023/01/16/in-virginia-carbon-emissions-drop-as-data-centers-boom-thanks-to-rggi-pact/

Virginia’s participation in an East Coast greenhouse gas emissions pact is pivotal to curbing the climate impact of its thriving data center industry.

Globally, northern Virginia has become one of the largest data center hubs over the last decade-plus. Offering generous tax incentives has attracted tech giants eager to construct massive server farms with proximity to crucial digital infrastructure. An estimated 70% of the world’s internet traffic moves through the suburbs of Washington, D.C., daily.

That burgeoning has propelled a surge in electricity use. In 2020, the sector consumed close to 12,000 gigawatt-hours in Dominion Energy’s territory — roughly one-sixth of the investor-owned utility’s total retail sales that same year.

And yet, the state’s carbon emissions from power plants have fallen 12% annually during the last two years.

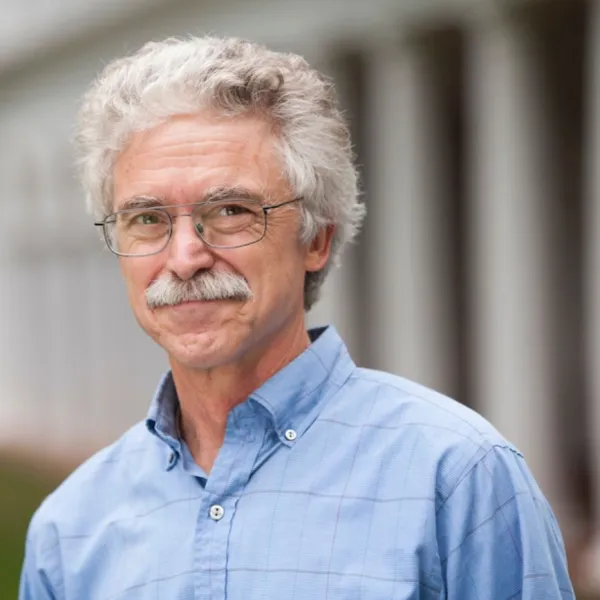

William Shobe, an environmental policy professor at the University of Virginia, is among those crediting the 11-state Regional Greenhouse Gas Initiative. Known as RGGI, the initiative is a voluntary carbon cap-and-invest venture designed to tamp down heat-trapping gases emitted by the utility sector. Virginia’s downward emissions trend will halt without that cap in place, Shobe said.

Even as electricity-hungry data centers multiply across the state, RGGI’s binding carbon cap keeps emissions in check. Basically, the amount of fossil fuels a utility is allowed to burn shrinks each year as the cap is lowered.

It’s a crucial dynamic to understand, Shobe said, as Republican Gov. Glenn Youngkin has vowed to extract Virginia from the market-based climate initiative.

“As a planetary citizen, I’m happy with that [cap],” said Shobe, who directs the Energy Transition Initiative at the University of Virginia’s Weldon Cooper Center for Public Service. “If the state relaxes RGGI, then data centers have climate consequences that we need to worry about.”

He’s hopeful that legislators won’t follow Youngkin’s lead on RGGI during the session that opened last Wednesday. Republicans control the House of Delegates while Democrats have a majority in the Senate.

Shobe also argues that continuing to build data centers in Virginia can be a net positive for climate change — assuming data centers will be built somewhere and the state stays committed to the regional greenhouse gas program. That construction trend shows no signs of abating in Virginia for at least the next 10 years.

“As long as we are a member of RGGI, then we should encourage data centers here rather than Ohio, Indiana or someplace else without a cap on carbon dioxide emissions,” Shobe said.

Shobe played a significant role in designing the mechanisms behind RGGI, which debuted in 2009. In a nutshell, each member state limits emissions from fossil fuel power plants, issues carbon dioxide allowances and sets up participation in auctions for those allowances.

In 2020, Virginia became the first Southern state to join RGGI, after ample back-and-forth bickering. Advocates have hailed the program for its climate benefits and the upward of $450 million the allowance auction has so far yielded for statewide flood resiliency projects, energy efficiency upgrades, and home repairs for low-income residents statewide.

Youngkin has been itching to extract Virginia from RGGI since he took office a year ago. In early December, the state’s Air Pollution Control Board voted 4-1 to accelerate that exit.

Attorneys with environmental organizations maintain that the Youngkin administration lacks the authority to leave the compact. That decision, RGGI proponents say, is in the hands of the General Assembly. A legislative effort to derail RGGI failed last year.

The air board’s initial vote to leave RGGI will trigger a 60-day comment period this winter. Shobe and his colleagues are prepared to weigh in with insights that the board will review before voting again on the proposal.

Shobe published an electricity use forecast in April 2021 predicting that data centers will be the driving force behind a 38% increase in electricity sales between 2020 and 2035. That equals an average increase in electricity use of around 44,000 gigawatt-hours per year.

“Whether we think this is a good thing or not, data centers are growing very fast,” Shobe said. “Unfortunately, they use a lot of energy. How we provide that energy is what will make a difference.”

Shobe noted that residential electricity sales are close to flatlining due to slower population growth and improved energy efficiency. Likewise, commercial and industrial demand have fallen for several years.

For the most part, large technology companies have pledged to power their facilities with renewable energy. However, it’s unclear whether or how they are following through on those commitments.

Thus far, Virginia’s solar expansion is on pace with a legislative mandate to decarbonize the grid by 2050, Shobe said. But the state can’t afford a solar stumble if it’s going to feed the needs of voracious data centers.

Some in the environmental community doubt that server farms will be able to live up to their vows to harness 100% of their energy from clean sources. Rooftop solar can’t cover those needs because the average solar array on a data center would only offset about 2.2% of its annual electricity consumption, according to calculations by solar developers.

That means operators resort to power purchase agreements, which allow them to go solar even if the utility-scale arrays they invest in are located miles away or in other states and might not be generating when data centers are consuming power.

Some are leery of those pacts. But Shobe defends the agreements as “perfectly fine ways” to contain greenhouse gases.

“If a data center has a solar farm built somewhere else to cover emissions, why wouldn’t you want to credit them for that?” he said, adding that his university does just that with two off-campus arrays. “From the point of view of resolving global warming, it doesn’t matter where it is built.

“As long as it’s on the same planet, it has the same effect on emissions.”

Shobe suggested that in the big picture, a third-party monitoring organization — along the lines of a Good Housekeeping seal of approval — should be tasked with holding data centers accountable for clean energy pledges.

“Enforcement is a tricky problem,” he said. “What it boils down to is, are people holding true to their promises?”

Boosting in-state solar capacity is far preferable to importing electricity because that might be sourced from states without a carbon emissions cap, Shobe said.

“The question is how fast we can add renewable energy,” especially over the next five or six years, he said. “We are going to have to be more aggressive and do it faster if we are going to be a center for data center construction.”

In the meantime, the air board’s vote and the start of Virginia’s new, two-month legislative session has ushered in fresh fears that the state’s progress could be stymied. Shobe said he and other RGGI champions will meet with lawmakers to tout the climate value of sticking with the cap-and-invest program.

Withdrawing from RGGI would halt the flow of auction allowances. Instead, in mid-December, Youngkin proposed replacing that with $200 million in taxpayer dollars dedicated to a Resilient Virginia Revolving Fund.

That shift away from the RGGI model signals a lack of commitment to tackling climate change, Shobe said, because it removes not only environmental certainty but also the incentive for utilities to pivot from high- to low-emitting generation.

In Virginia, he emphasized, the original reason for joining RGGI was about having a cost-effective tool for reducing emissions. Producing revenue was an afterthought.

“If what the governor is hoping is that we will give up on achieving carbon dioxide reductions, that’s another matter,” Shobe said. “If we’re serious about reducing carbon emissions, we need to be thinking ahead and asking ourselves what our energy portfolio is going to look like.”